- Personal

- Business

-

Corporates

-

Investments

- Mutual Funds

- Stock and Securities

-

Advisors

-

Investments

- Mutual Funds Advisors

- Stocks & Securities Advisors

-

Complete Money Solutions

- Select Advisor

- Careers

- ABCL

- Company Profile

- Board of Directors

- Leadership Team

- Our Vision and Values

- Our Achievements

- History & Heritage

- Corporate Governance

- Investor Relations

- Careers

- CSR and Sustainability

- Press and Media

- ABCL

- Policy for appointment of Statutory Auditors

- ABCL NRC Policy

- Corporate Social Responsibility

- Fair Practices Code

- Internal Guidelines on Corporate Governance

- Familiarization Programme for Independent Directors

- Disclaimers

- Ombudsman

- Privacy Policy

- Trademark Policy

- Vigil Mechanism / Whistle Blower Policy

- Regulatory Disclosure

- Public Issue of Debt

- Properties for Auction under SARFAESI Act

- Secured Assets Possessed Under SARFAESI

- ECLGS (Emergency Credit Line Guarantee Scheme)

- Press Releases

- Our Digital Lending Platform Partners

- Our Digital Referral Partners

- ABCL Collection and Recovery Agency List

- ABFL Terminated Collection and Recovery Agency List

- Importance of Following Repayment Schedule

- Scheme of Amalgamation

- SEBI Disclosures

- Interest Rate & Service Charges

- Discontinued Service provider list

- Terms & Conditions

- Archival Policy

- Fraud Awareness

Aditya Birla Capital Limited (“ABCL”) is a listed systemically important non-deposit taking Non-Banking Financial Company (NBFC) and the holding company of the financial services businesses. Through its subsidiaries/JVs, ABCL provides a comprehensive suite of financial solutions across Loans, Investments, Insurance, and Payments to serve the diverse needs of customers across their lifecycles. Over 1,482 branches and more than 200,000 agents/channel partners along with several bank partners.

Nationwide Branches

1,482

No. of Employees

59,000

Agents/Channel Partners

2,00,000+

Aggregate Assets

INR 3,550 Billion

Active Customer Base

39 Million

Consolidated Lending Book

INR 699 Billion- ABCD Of Money

- Read about Money

- Read about Tax

- Read about Retirement Plan

- Read about Insurance

- Read about Investing

- Read about Loans and Financing

- ABCD Of Calculators

- Personal Loan EMI Calculator

- Home Loan Eligibility Calculator

- BMI Calculator

- Income Tax Calculator

- SIP Calculator

- SWP Calculator

- Personal Finance

- Eligibility Calculator

- EMI Calculator

- Application Forms

- Brochure

- FAQs

- Financial Reports

- SME and Business Finance

- SME & Business Finance FAQs

- Account Statement

- Financial Reports

- Forms

- Brochure

- Grievance Form

- Loan Against Property

- Loan Against Property FAQs

- Account Statement

- Financial Reports

- Forms

- Brochure

- Grievance Form

- Housing Loan

- Personal Finance

- SME & Business Finance

- Gold Loan

- Loan Against Property

- Loan Against Securities

- Corporate Finance

Find customised home loan solutions for your unique needs

Find a better interest rate for your existing home loan

Get a loan on your existing home loan to meet your needs

Turn your assets into a financial ally

Meet all your dreams and needs with a collateral-free Personal Loan

Make loan repayment flexible and hassle-free with Flexi Loans

Get quick funds with Aditya Birla Capital Instant Personal Loan

Enjoy affordable repayments and a flexible tenure with Aditya Birla Capital

Check your Aditya Birla Capital Personal Loan eligibility

Enjoy low personal loan interest rates for affordable repayments

Are you eligible for a Personal Loan? Find out now!

CALCULATE NOWBoost your business with competitive rates & flexible terms

Get anytime funds, quick approval, & ongoing support with Line of Credit

Strengthen your business cash flow with quick access to funds & flexible repayment options

Improve your cash flow & gain quick access to funds by discounting your invoices

Fuel your business with fast approval & flexible terms

Our solutions with Flexible funding, project requirements to drive construction forward.

Turn your property vision into reality with flexible terms and competitive interest rates.

Supporting real estate businesses in project completion

Leverage your investments with Loan Against Shares, while retaining ownership of your assets

Unlock the value of your investments while keeping your assets intact

Get loans for all your business needs at attractive rates

Seize investment opportunities with IPO Financing to help you invest with ease.

Empower your business growth with financial solutions to support expansion & ownership

Turn your ideas into reality with flexible funding to support your vision from start to finish

Turn your ideas into reality with flexible funding to support your vision from start to finish

Keep your business running smoothly with quick access to funds for day-to-day operations

Achieve your business goals with flexible repayment options & competitive rates for long-term growth

Diversify your portfolio and reduce risk with Debt Funds

Invest smartly in Equity Funds to aim for higher returns

Diversify your portfolio and reduce your risk with a mix of equity and debt

Retirement Funds

Children’s Funds

Exchange Traded Funds

Choose the smart way to diversify risks and grow investments

Follow the benchmark of smart investors to grow your wealth

Calculate wealth creation through lumpsum investment in Mutual Funds

Calculate NowBring security and peace to life’s unpredictability

Get a guaranteed regular pension plus a lump sum on plan maturity

Get a guaranteed regular pension plus lump sum on plan maturity

Get a guaranteed regular pension plus lump sum on plan maturity

Find out how much life insurance you need with our Human Life calculator

CALCULATE NOWProtect your vision with comprehensive eye insurance.

Protect your smile with comprehensive dental insurance and coverage plans tailored for you.

Get financial support with our hospital cash insurance for unexpected medical expenses.

Get the best mental health insurance online with ABCD Aditya Birla Capital today!

Secure your future with our affordable personal accident insurance plans.

Aditya Birla Capital Limited

Aditya Birla Capital Limited

Aditya Birla Capital Limited (“ABCL”) is a listed systemically important non-deposit taking Non-Banking Financial Company (NBFC) and the holding company of the financial services businesses. Through its subsidiaries/JVs, ABCL provides a comprehensive suite of financial solutions across Loans, Investments, Insurance, and Payments to serve the diverse needs of customers across their lifecycles. Over 1,482 branches and more than 200,000 agents/channel partners along with several bank partners.

Nationwide Branches

1,482

No. of Employees

59,000

Agents/Channel Partners

2,00,000+

Aggregate Assets

INR 3,550 Billion

Active Customer Base

39 Million

Consolidated Lending Book

INR 699 BillionCorporate Governance Policies

- Policy for appointment of Statutory Auditors

- ABCL NRC Policy

- Corporate Social Responsibility

- Fair Practices Code

- Internal Guidelines on Corporate Governance

- Familiarization Programme for Independent Directors

- Disclaimers

- Ombudsman

- Privacy Policy

- Trademark Policy

- Vigil Mechanism / Whistle Blower Policy

- Regulatory Disclosure

Financial and Debt-Related Policies

Business and Partnership Policies

- Press Releases

- Our Digital Lending Platform Partners

- Our Digital Referral Partners

- ABCL Collection and Recovery Agency List

- ABFL Terminated Collection and Recovery Agency List

- Importance of Following Repayment Schedule

- Scheme of Amalgamation

- SEBI Disclosures

- Interest Rate & Service Charges

- Discontinued Service provider list

- Terms & Conditions

- Archival Policy

- Fraud Awareness

- My Track

- ABCD Of Money

- ABCD Of Calculators

- Personal Finance

- SME and Business Finance

- Loan Against Property

- Loan Against Securities

- Corporate Finance

Money management made easy

Understanding direct and indirect taxes

Know how to plan retirement well

Insurance and it's aspects for laymen

Investments and their jargon - simplified

Know all about loans and their management

Estimate your monthly loan repayments with Personal Loan EMI Calculator

Calculate the expected EMI of your loan for easier repayments

It measure your leanness or obesity basis your height and the weight.

Calculate the tax payable by you based on your income

Estimate the returns you can earn with your SIP investments

Calculate the Life Insurance cover you need to secure your family’s future

Check your credit score and get tips on how to improve it

Healthy living made easy with ABCD’s Digital Health Evaluation

Bring your assets and liabilities under one platform

Manage your money effectively with Spend Track.

Manage your money effectively with Spend Track.

Manage your money effectively with Spend Track.

Check your credit score and get tips on how to improve it

Healthy living made easy with ABCD’s Digital Health Evaluation

Manage your money effectively with Spend Track.

Bring your assets and liabilities under one platform

Manage your money effectively with Spend Track.

Manage your money effectively with Spend Track.

Check your credit score and get tips on how to improve it

Healthy living made easy with ABCD’s Digital Health Evaluation

Manage your money effectively with Spend Track.

Bring your assets and liabilities under one platform

Manage your money effectively with Spend Track.

Manage your money effectively with Spend Track.

Check your credit score and get tips on how to improve it

Healthy living made easy with ABCD’s Digital Health Evaluation

Manage your money effectively with Spend Track.

Bring your assets and liabilities under one platform

Manage your money effectively with Spend Track.

Manage your money effectively with Spend Track.

Check your credit score and get tips on how to improve it

Healthy living made easy with ABCD’s Digital Health Evaluation

Manage your money effectively with Spend Track.

Bring your assets and liabilities under one platform

Manage your money effectively with Spend Track.

Manage your money effectively with Spend Track.

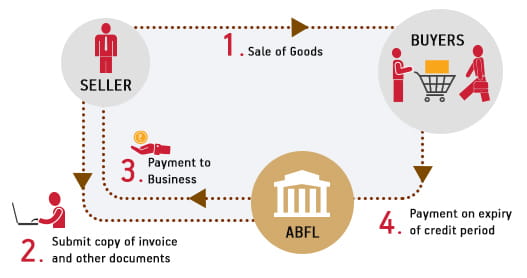

Supply Chain Financing Solutions

Enables you to convert your receivables into cash which in turn improves liquidity resulting into a healthy and continuous cash flow for your business.

-

Vendor Finance

-

Channel Finance for Manufacturers

-

Channel Finance for Traders

Supply Chain Financing Solutions - Invoice Discounting

This solution provides finance by discounting the sales bills of your vendors or by discounting your purchase bills. This financing facility is also available for your channel partners. Besides regular bill discounting, we also service bill discounting backed by Letter of Credit (LCBD).

Some of the benefits of this financing solution are:

- Instant conversion of receivables into cash

- Helps to build strong relationships with vendors and channel partners

- Assures availability of working capital finance to channel partners and vendors at competitive costs of credit

- Facilitates increased sales through higher purchasing power for channel partners

- Faster payments leading to cash discounts from companies

- Faster Turnaround Time (TAT) and simple procedures

Supply Chain Financing Solutions include: Sales Bill Discounting, Purchase Bill Discounting and Letter of Credit Bill Discounting.

Supply Chain Financing FAQ's

Supply chain finance (SCF) refers to a range of technology-driven solutions designed to reduce financing costs and enhance business efficiency for buyers and sellers engaged in a sales transaction. SCF methodologies achieve this by automating transactions and monitoring invoice approval and settlement processes from initiation to completion.

Supply chain finance involves a collaboration between a buyer and a financial institution. Under this arrangement, the financial institution pays the suppliers directly on behalf of the buyer. While suppliers may need to enrol in the program, it's the responsibility of the buying company to initiate and establish this arrangement.

The primary advantage of supply chain finance is that the buyer incurs no fee to extend its payment terms, and the supplier only pays a minimal discount if they opt for early payment of a supply chain loan.

Supplier finance applies to companies across diverse sectors, including automotive, electronics, manufacturing, retail, and others. It benefits organisations on both sides of the supply chain, allowing buying entities to extend their payment terms while suppliers can receive earlier payments.

Under Supply Chain Finance, various supply chain financing solutions are offered to facilitate smooth transactions between buyers and sellers. Some common types include:

- Invoice Discounting

- Dynamic Discounting

- Supply Chain Financing Platforms

- Receivables Finance

- Payables Financing

- Inventory Financing

- Purchase Order Financing

- Channel Financing

Sales Bill Discounting, Purchase Bill Discounting and Letter of Credit Bill Discounting.

1800 270 7000

1800 270 7000